The Rise of Digital Lending Platforms in India in Covid19

What is it?

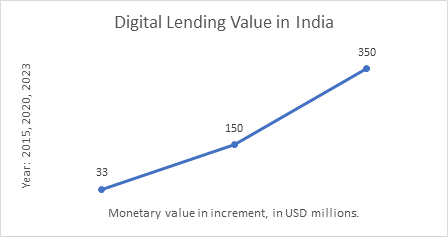

Digital Lending refers to the borrowing of money through online platforms or mobile apps, which mainly makes use of technology for verification, credit approval, and disbursal. As can be seen from the chart below, India’s digital lending market is witnessing a surging upward trend in the last 6 years.

Why Digital Lending?

It is very common for Indians to borrow money from family, friends, and moneylenders. Sometimes, these finances are given at excessively inflated rates. Because they stand a chance of getting rejected from banks because of their credit score or inconsistent or low incomes, most Indians prefer to borrow from these sources as they are more convenient.

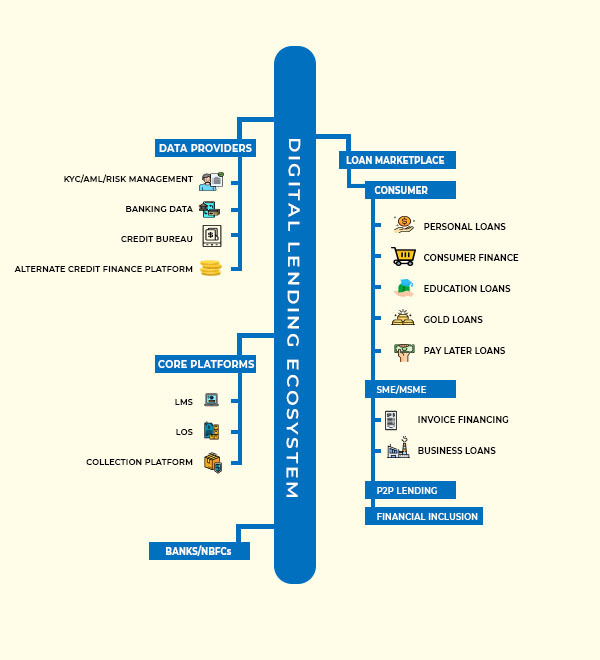

Digital lending platforms, on the other hand, assure that customers, regardless of their credit score or income range, get the loan that they require. They help in meeting the huge unmet credit need, especially in the microenterprises and low-income customer base in India. In short, the concept of digital lending has evolved into a powerful medium for reaching out to those who have not previously gained access to institutional financial services.

By just logging on to your smart device, almost anyone can apply for a loan. No visits to the bank required, and the whole process takes place completely digitally. A few clicks, a few eligibility checks performed, and you are good to go – you can receive your loan within the next few days from the comfort of your own house.

Furthermore, getting your loan sanctioned by a conventional bank can be a laborious process. After gathering all your paperwork and visiting multiple branches in person, you would have to await the manual verification process. This means that it may take months, in some cases, for the money to reach your account. With digital lending, however, the whole process takes less than a week. From the time you take to apply for the loan, to the verification process, and finally the disbursal of the money, the whole process is quite swift. And instead of being required to submit countless paperwork to verify your identity and credit eligibility, digital lending requires only a couple of fundamental KYC documents; essentially your identity and income proof.

Some instant personal loan companies like StashFin offer unsecured loans in the range of Rs 1,000 to Rs 5 lakh, depending on the creditworthiness of the borrower.

Digital Lending and the Pandemic

The concept of digital lending is definitely a great advantage, particularly in times of a pandemic where we are advised to not leave home as much as possible for our safety. The restriction placed on physical contact has made it inevitable for a bank or money lending company to offer digital financial services. Applying for loans from our homes ensure that we can borrow money without putting ourselves at risk.

A report conducted by SBI (State Bank of India) asserts that digital payments assist banks in maintaining brand recognition, boosting customer engagement, and generating cross-selling opportunities. This suggests that digital lending and online financial services are beneficial not just for the customer but also for the banking and non-banking financial companies. It is also noted that the Indian Government’s efforts to enhance financial inclusion and have the economy less reliant on cash have caused an upward surge in the use of digital financial services, especially electronic payments.

With the rapid shift of banking operations toward online platforms, obtaining a loan is becoming only easier. With incipient new age technologies, the future of digital lending seems to be optimistic.